1,577 days, 2,409 entries ...

Newsticker, link list, time machine: HOLO.mg/stream logs emerging trajectories in art, science, technology, and culture––every day

“It is really disheartening to watch artists I respect run to do ordinals. Can’t help but remember the rough convos we had around energy use and carbon load of ETH.”

David Golumbia

(1963-2023)

“This new study is different because it measures tiny variations in the way that Bitcoin mining equipment generates random numbers. These variations serve as a fingerprint allowing us to directly estimate the proportion of different machines.”

“I think the Bitcoiners that are celebrating these enforcement actions tend to be later on the adoption curve and lower on the IQ spectrum than folks that actually know what’s going on. They’re cultists.”

Danny Franzreb

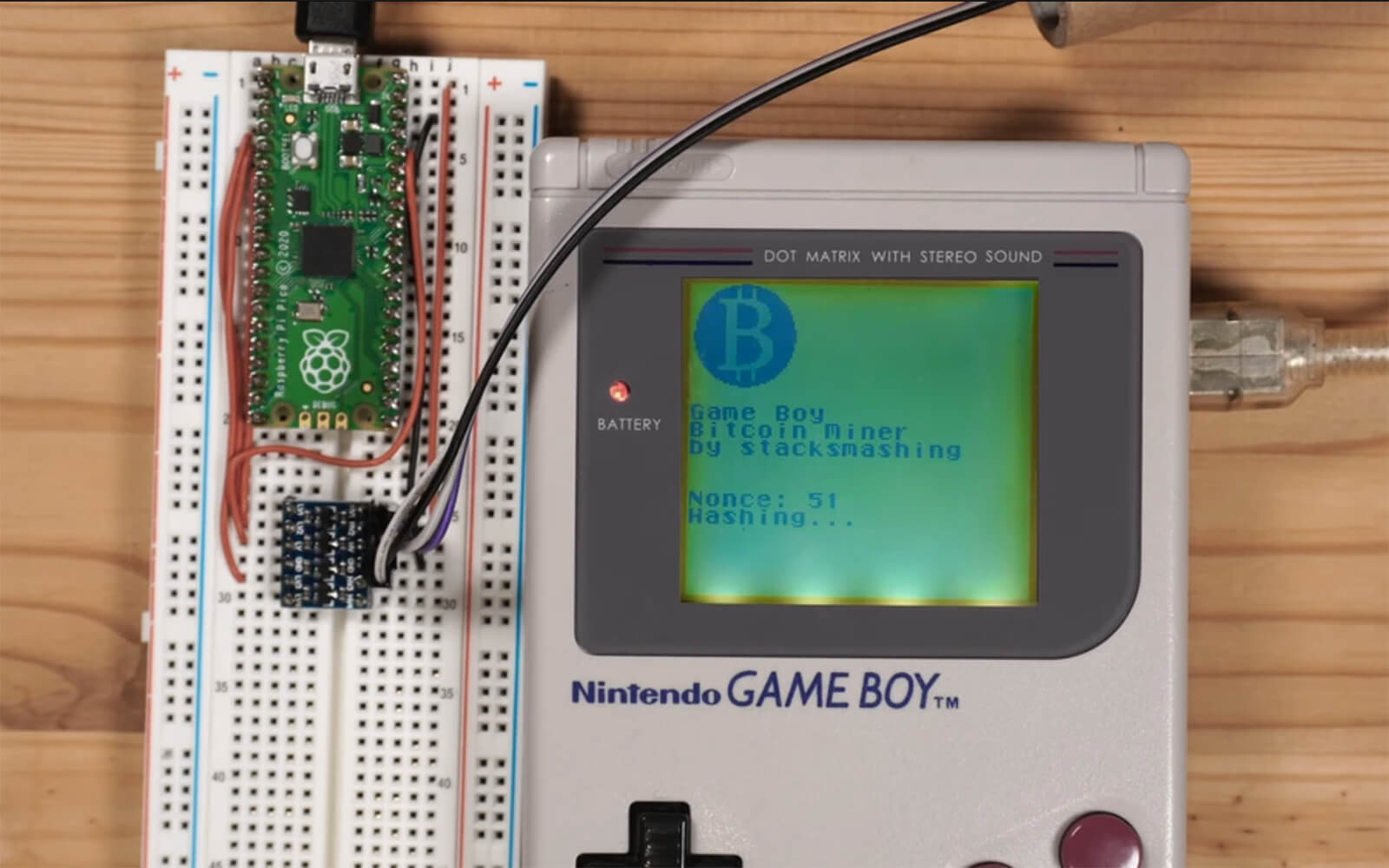

Proof of Work

Daniel Franke’s CGI short Ich sitze in der Wolke (2022) premieres at the Kassel Documentary Film and Video Festival in Kassel, Germany. In his film, the German artist and researcher takes viewers deep into the digital cloud, a GAN-generated post-nature dreamscape where semiconductors, bitcoins, electricity, rare earth minerals, and crystals manifest to force questions about “environmental sin and digital evolution.”

“Ditch the pronouns and hit the gym, then you’ll realize the importance of Proof of Work.”

“Starting today we are reviewing if and how our current policy on crypto donations fits with our climate goals. And as we conduct our review, we will pause the ability to donate cryptocurrency.”

“Talking about building this city beside a volcano is like thinking you are rich because you live next to a bank.”

In an attempt to become the “Singapore of Latin America,” President Nayib Bukele announces El Salvador will bootstrap an entire city around Bitcoin’s economic prospects. Building on the country’s recent recognition of the leading cryptocurrency as legal tender, the so-called “Bitcoin city” will be located along the Gulf of Fonseca near the base of Conchagua volcano, the geothermal energy of which will be harnessed to power the city and an industrial-scale Bitcoin mining operation. Honouring the libertarian ethos that is common amongst Bitcoin-boosters “the city will have no income, property, capital gains, or payroll taxes.”

“The lifespan of bitcoin mining devices remains limited to just 1.29 years. As a result, we estimate that the whole bitcoin network currently cycles through 30.7 metric kilotons of equipment per year.”

“At any time, the finance industry could have suggested or demanded design changes. It didn’t. Artists did,” writes Charlotte Kent in an op-ed on how NFT creators force a debate about blockchain tech and the environment. Surveying key works including Memo Akten’s Cryptoart.wtf and John Gerrard’s Crystalline Work (Arctic) (image), Kent rejects the notion that crypto art is beholden to an (energy-intensive) Ethereum- and Bitcoin-rich collector class. “Diversifying is in the spirit of the distributed ledger.”

Authorities in the city of Miri in Sarawak, Malaysia seized 1,069 rigs from Bitcoin miners alleged to have stolen $2 million USD worth of electricity. “The electricity theft for mining Bitcoin activities has caused frequent power outages, and in 2021, three houses were razed due to illegal electricity supply connections,” explains Miri police chief ACP Hakemal Hawari. Six individuals were arrested, fined, and jailed in the sting; the police then proceeded to crush the hardware, worth an estimated $1.25 million USD, with a steamroller.

“China is rolling its own cryptocurrency and has every incentive to have as little competition as possible. I think we will see miners leaving China and relocate where there is spare or cheap energy.”

“Flare gas could just as well power carbon capture machines, water desalination plants, or data centres that support more widely used applications. There’s a social value in those things that I don’t see for Bitcoin.”

“There is no comparable asset to Bitcoin. You have another category, let’s call it ‘unicorns.’ I’d put Ethereum in there, it’s a unicorn like Airbnb or Uber, it’s big … it’s complicated and compelling, there are a lot of people enthusiastic about it.”

“Almost 70,000 bitcoins stored in the account which, like all bitcoin wallets, is visible to the public, had lain untouched since April 2013. The website was shut down by an FBI raid six months after they were deposited, and they have not moved since.”

Daily discoveries at the nexus of art, science, technology, and culture: Get full access by becoming a HOLO Reader!

- Perspective: research, long-form analysis, and critical commentary

- Encounters: in-depth artist profiles and studio visits of pioneers and key innovators

- Stream: a timeline and news archive with 1,200+ entries and counting

- Edition: HOLO’s annual collector’s edition that captures the calendar year in print